Exporting goods isn't just about trade—it’s about ensuring that sensitive items don't threaten global security. India's SCOMET policy regulates dual-use goods with civilian and military applications, ensuring exports are handled responsibly to protect both national and international interests.

The SCOMET policy covers items like chemicals, materials, and advanced technologies, aligning India's export practices with global non-proliferation standards. By complying with this framework, businesses contribute to ethical and secure trade while avoiding potential penalties.

For exporters, understanding the SCOMET policy is more than just a regulatory requirement—it's a way to enhance credibility and build trust in international markets. By delving into its categories and processes, businesses can streamline their operations and contribute to responsible global trade.

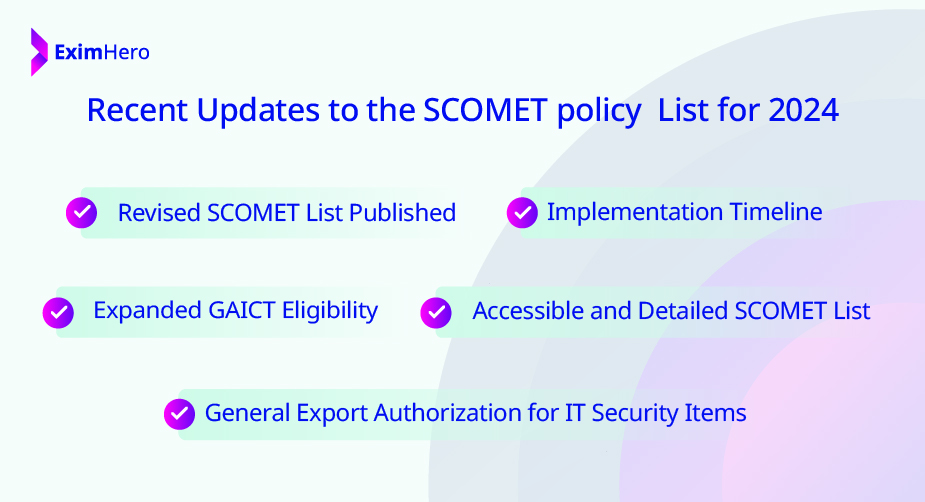

Recent Updates to the SCOMET policy List for 2024

Recent Updates to the SCOMET policy List for 2024

Revised SCOMET List Published

The Directorate General of Foreign Trade (DGFT) has revised Appendix 3 under Schedule 2 of the ITC (HS) classification for 2024. Changes reflect global developments and stakeholder feedback, with new entries highlighted for clarity.

Implementation Timeline

The revised SCOMET policy will take effect 30 days from its publication date, providing exporters adequate time for compliance.

Expanded GAICT Eligibility

The updated guidelines include a broader scope for Global Authorization for Intra-Company Transfers (GAICT) of SCOMET items, covering software, technology, and specific components.

General Export Authorization for IT Security Items

A new provision enables simplified export of certain IT security products classified under SCOMET Category 8A5 Part 2, reducing administrative burdens.

Accessible and Detailed SCOMET List

Exporters can now access the complete and updated list of controlled items and export compliance requirements directly on the DGFT website.

What Are the Comprehensive SCOMET Categories Listed Under the SCOMET Policy?

SCOMET items are grouped into nine categories, each governing different types of sensitive goods and technologies. Here's an overview of these categories:

Category 0: Nuclear materials and related technologies.

Category 1: Toxic chemical agents and other controlled chemicals.

Category 2: Microorganisms and toxins.

Category 3: Materials and equipment linked to materials processing.

Category 4: Nuclear-related items not wrapped under Category 0.

Category 5: Aerospace designs, equipment, and corresponding technologies.

Category 6: Munitions list.

Category 7: Reserved (specific items yet to be designated).

Category 8: Special materials, equipment, electronics, navigation, aerospace, and propulsion systems.

Each category has specific requirements for authorization and documentation. For instance, Category 0 items demand higher scrutiny due to their nuclear applications, while Category 8 covers a wide array of advanced technologies crucial for defense and commercial sectors.

Why SCOMET Authorization Matters

Exporting SCOMET items without authorization is a severe offense under the Foreign Trade (Development and Regulation) Act, inviting hefty penalties. Obtaining proper authorization ensures that Indian exporters comply with international standards and maintain India's commitment to non-proliferation.

Authorization Process: Steps and Prerequisites

To apply for SCOMET authorization, exporters must:

Register with the DGFT and ensure their Importer-Exporter Code (IEC) is linked to their profile.

Digital Signature Certificate (DSC): Ensure a valid DSC is registered in the DGFT's system.

Update Profile: Complete any necessary updates to the user profile before submission.

Once these steps are complete, the exporter can apply through the DGFT's Export Management System. Applications are either ANF 2O(a) for regular SCOMET items or ANF 2O(b) for items requiring Global Authorization for Intra-Company Transfers (GAICT).

What Are the Key Application Features of the SCOMET Policy, Including Amendments, Revalidation, and Site Visit Procedures?

Exporters may need to amend or revalidate their SCOMET authorization. Amendments can include adding new items, changing quantities, or modifying units of measure. On the other hand, a revalidation allows an authorization extension for six months at a time, with a fee of INR 500.

The SCOMET policy mandates a Site Visit Authorization for companies operating under foreign collaboration. This authorization is required if a company must facilitate site visits or inspections by foreign governments or entities to verify SCOMET items.

Post-Reporting Obligations

In addition to obtaining initial authorization, companies must sometimes adhere to post-reporting requirements. This reporting is mandatory in scenarios such as:

Export of chemicals to specific countries.

Repair and return of SCOMET items sent abroad.

Return of items after exhibitions, tenders, or demos.

GAICT exports under particular conditions.

Post-reporting ensures that exports remain compliant throughout the lifecycle, helping companies maintain transparency and accountability.

What Are the Best Practices for Ensuring Compliance with the SCOMET Policy?

Ensuring compliance with SCOMET regulations involves more than just obtaining authorization. Here are some best practices:

Accurate Categorization: Verify that items are correctly categorized under the relevant SCOMET categories.

Document Record-Keeping: Maintain all records related to applications, approvals, amendments, and post-reporting.

Stay Updated: Regularly monitor updates from DGFT, as SCOMET policies can change based on international regulations and security dynamics.

Staff Training: Ensure your compliance and logistics teams are well-versed with SCOMET regulations and can identify controlled items in their categories.

How GSTHero Supports Exporters with SCOMET Compliance

Exporting goods, especially those regulated under the SCOMET policy, can be complex and time-consuming. GSTHero offers advanced tools to simplify compliance and enhance efficiency.

Streamlined Documentation and Reporting

GSTHero automates the preparation of critical export documents and ensures accurate categorization of SCOMET items. Minimizes mistakes and speeds up the authorization procedure.

Real-Time Regulatory Updates

With GSTHero, exporters receive timely notifications about changes in export regulations, including SCOMET updates, which will help businesses stay compliant and avoid penalties.

Seamless IEC Management and Post-Reporting

GSTHero assists businesses in managing their Importer-Exporter Code (IEC) and fulfilling post-export reporting requirements effortlessly. Its user-friendly platform reduces administrative burdens, allowing companies to focus on expanding their global trade footprint.

Conclusion: Balancing Trade and Security with SCOMET

The SCOMET policy represents India's commitment to balancing trade facilitation with global security imperatives. By complying with these regulations, exporters play a critical role in supporting India's stance on responsible trade practices. For companies, understanding and adhering to SCOMET guidelines fosters secure trade and strengthens India's standing in the global export community.

Navigating SCOMET compliance may seem daunting initially, but exporters can align with national interests and global standards with the right approach. Businesses can achieve streamlined, secure, and compliant exports by integrating these best practices into their processes.

FAQ On SCOMET Policy

SCOMET, which stands for Special Chemicals, Organisms, Materials, Equipment, and Technologies, refers to India's export control system. It includes a comprehensive list of regulated items, focusing on sensitive goods and technologies to ensure adherence to both domestic laws and international trade and security protocols.

The Importer-Exporter Code (IEC) acts as a distinctive identification number assigned to businesses or individuals engaged in global trade activities. It is a mandatory requirement for anyone looking to import goods into India or export products from the country unless they fall under specific exemptions outlined by the regulations.

Category 5 of the SCOMET list focuses on aerospace designs, equipment, and associated technologies. This includes items used in space exploration and aviation.

The SCOMET Declaration format is a mandatory document for exporters, detailing item descriptions, end-use, and end-user information to ensure compliance with export control regulations.

SCOMET regulates a wide range of items, including nuclear materials, toxic chemicals, microorganisms, aerospace equipment, and munitions. The items are grouped into nine categories for streamlined classification.

To obtain a SCOMET certificate, exporters must register with the DGFT, apply to the online platform, and provide required details about the items and their end-use.

The cost of obtaining a SCOMET license varies based on the type and category of goods. Exporters must pay processing fees as prescribed by the DGFT during the application process.

Businesses need to apply for an Importer-Exporter Code (IEC) through the DGFT, which is a mandatory requirement for engaging in international trade to become a registered exporter.

India's Foreign Trade Policy (FTP) is a comprehensive framework that outlines strategies, guidelines, and incentives to promote and regulate international trade, enhancing exports while ensuring compliance.

RoDTEP (Remission of Duties and Taxes on Exported Products) is a government scheme designed to reimburse taxes and duties incurred during the production and export of goods, making Indian products globally competitive.